0 | 1,018 | 03 Mar 2026

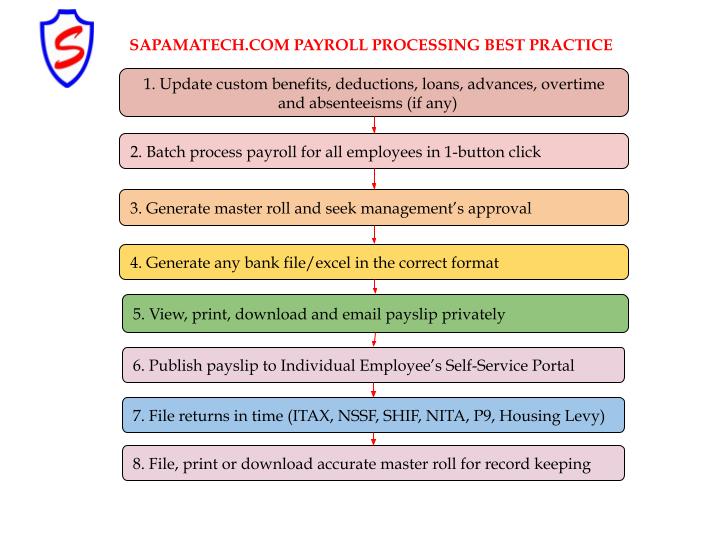

This is a guide on how to process payroll following industrial best practices for effective payroll management in 8 simple steps

Youtube video:

Click to open video in new tab

Step 1: Update custom benefits, deductions, loans, advances, overtime and absenteeism (if any)

Ensure that you've first updated all staff details and records.

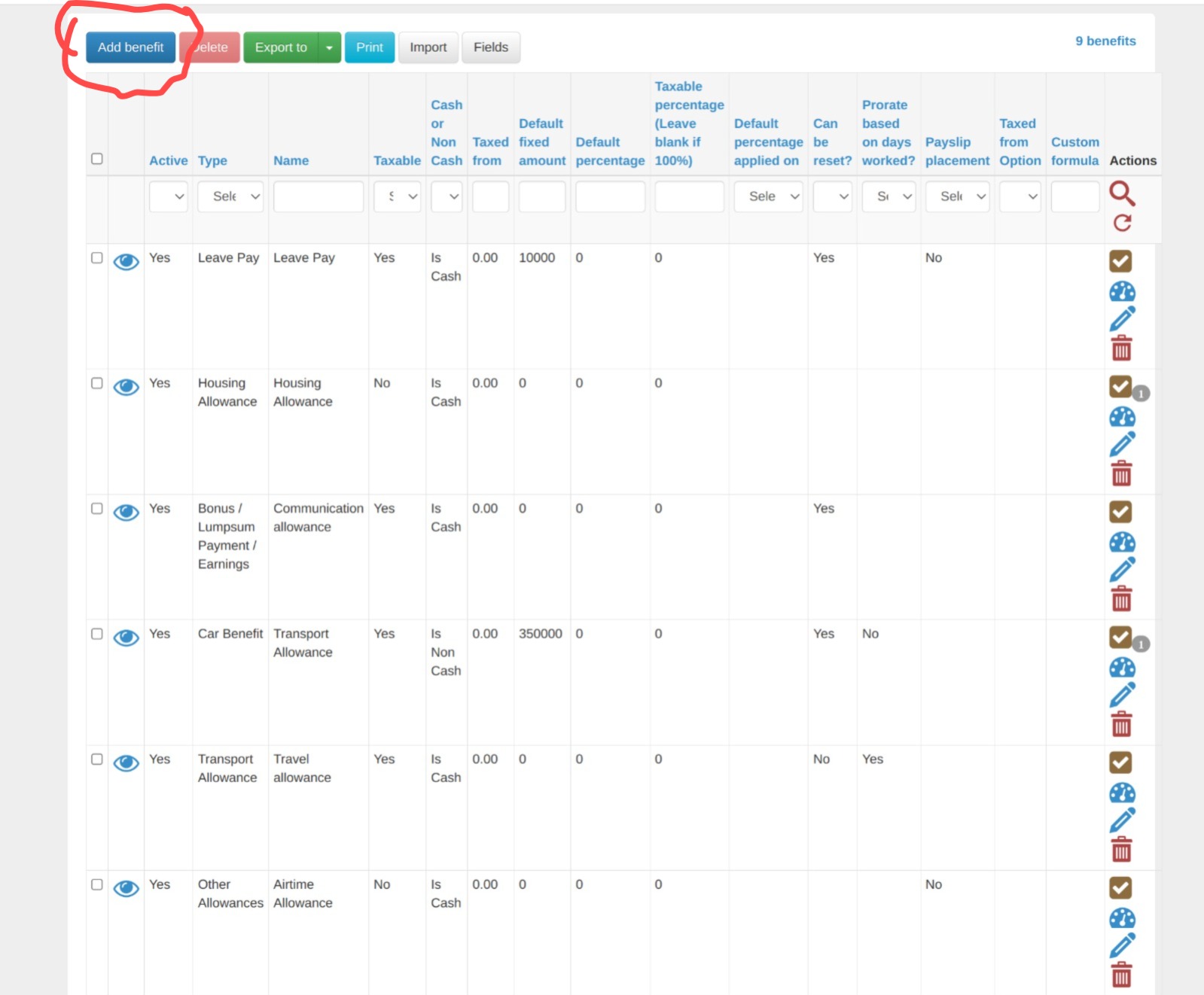

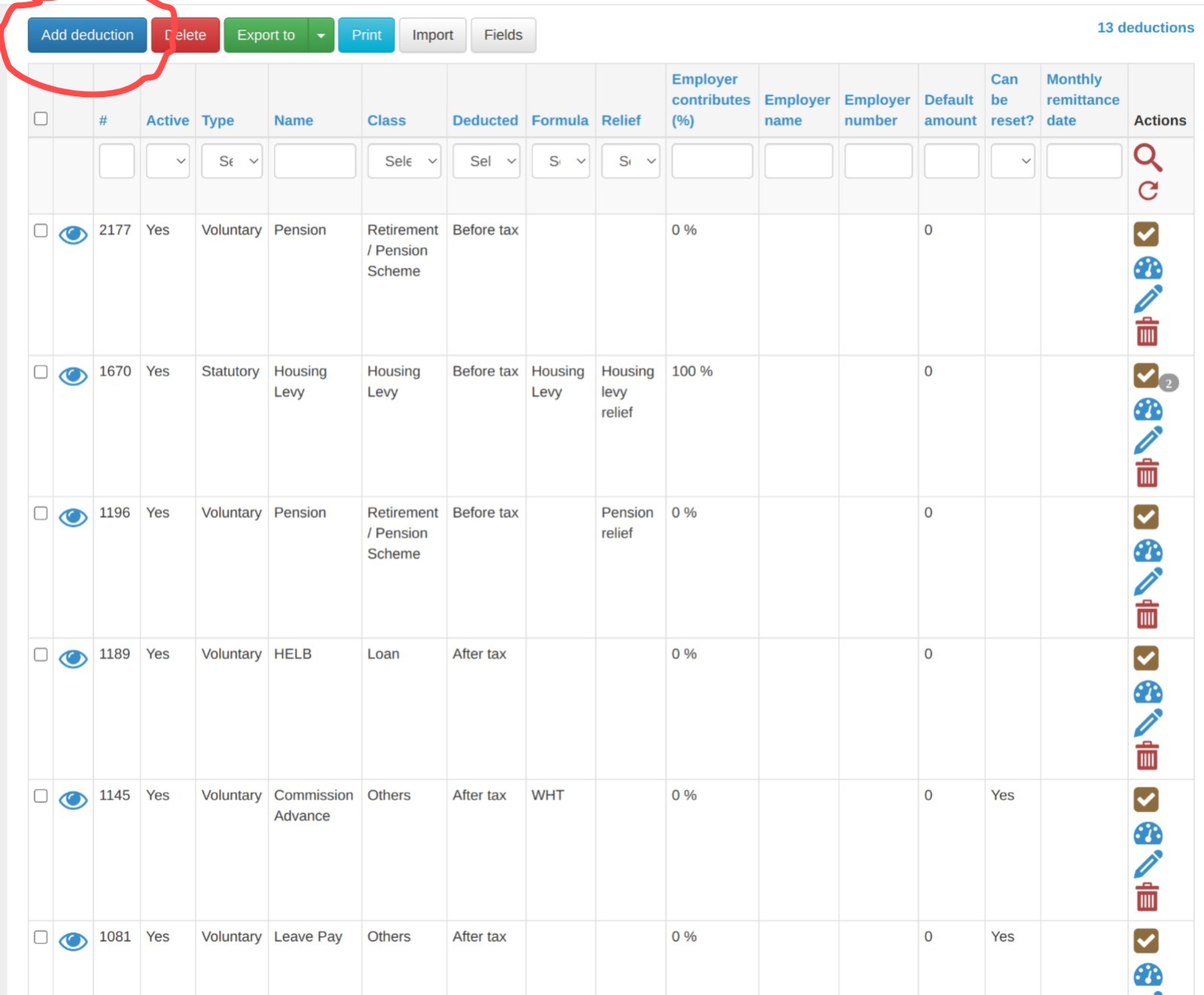

Add or define custom or organizational-specific benefits (eg Housing Allowance, Transport Allowance) and deductions (eg welfare, SACCO). Note that the statutory deductions (PAYE, NSSF, SHIF, Housing Levy, NITA) are already setup and in-built and no action is needed.

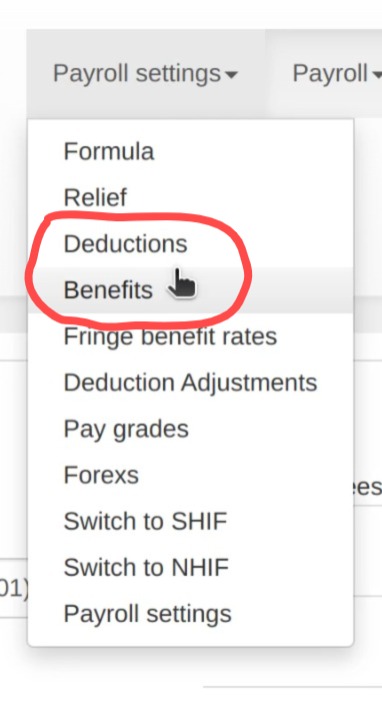

Manage custom benefits. Go to "Payroll Settings" > "Benefits" link > "Add benefit" button

Manage custom deductions. Go to "Payroll Settings" > "Deductions" > "Add deductions" button

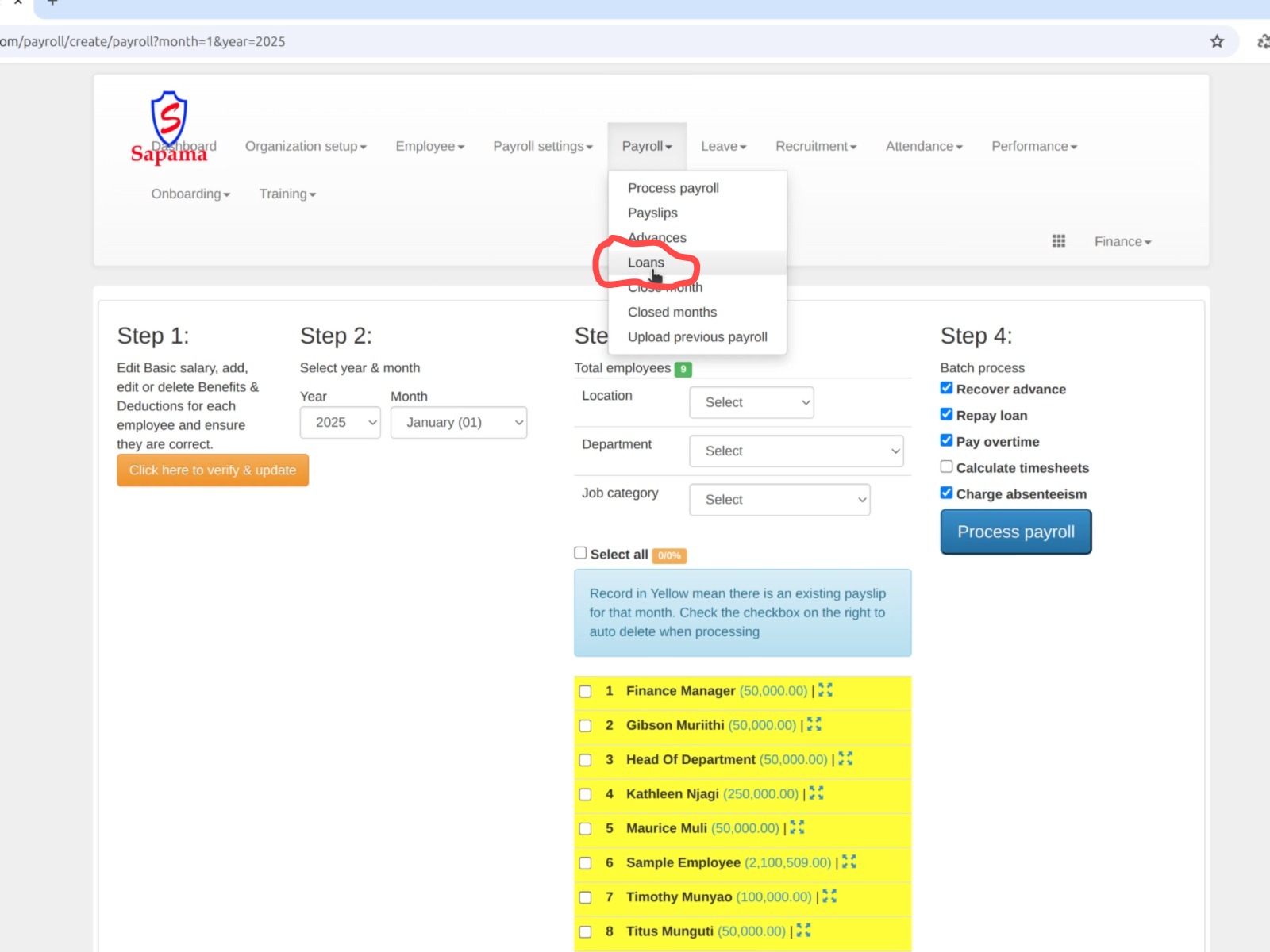

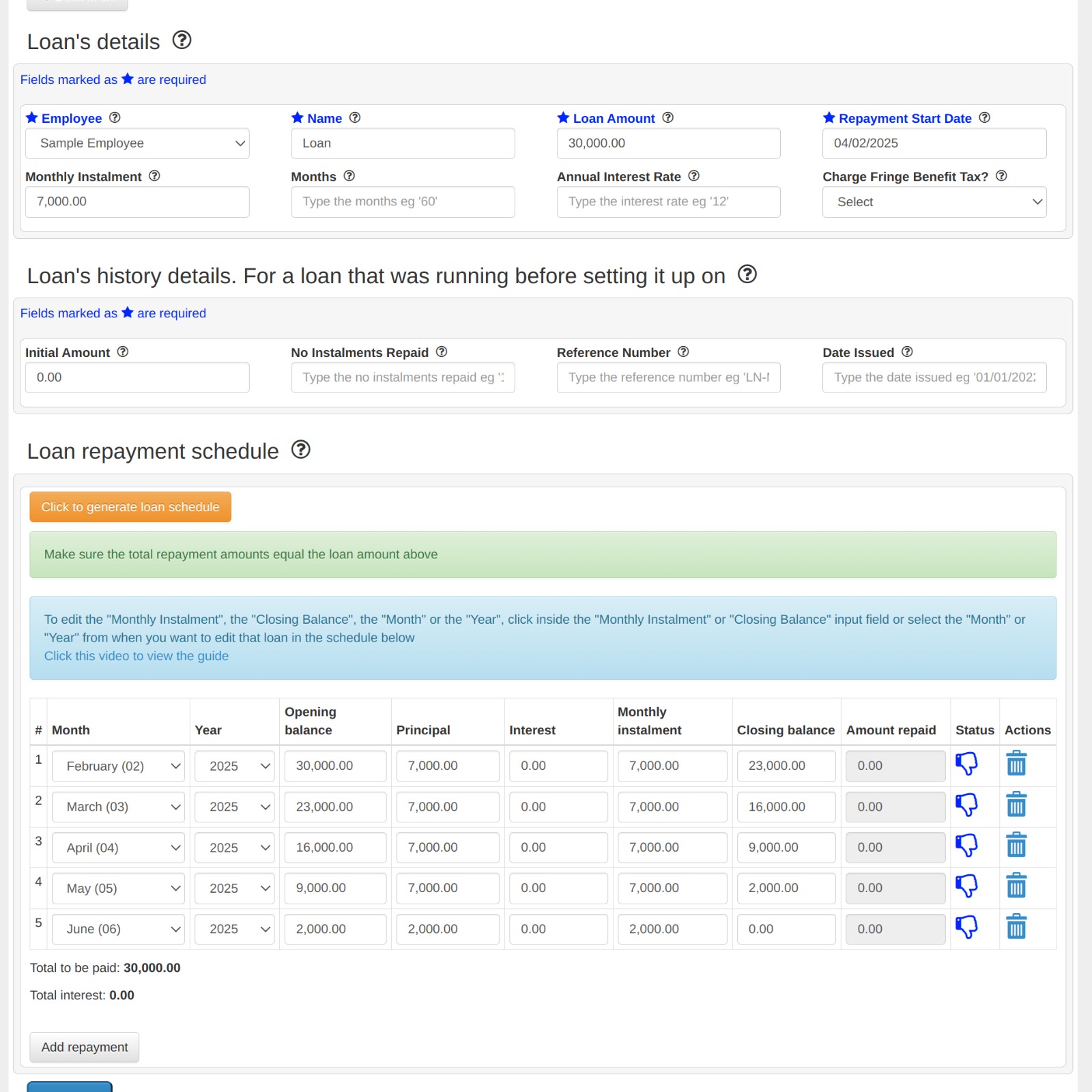

Manage loans. Go to "Payroll" > "Loans" > "Add loan" button

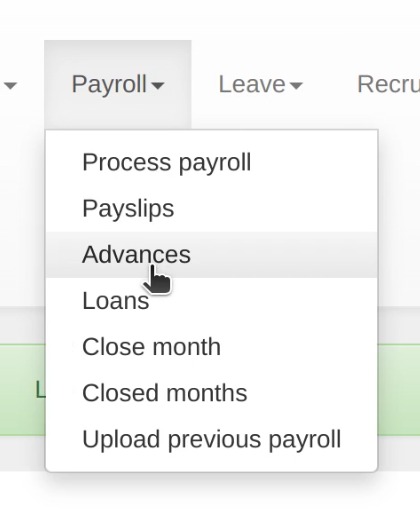

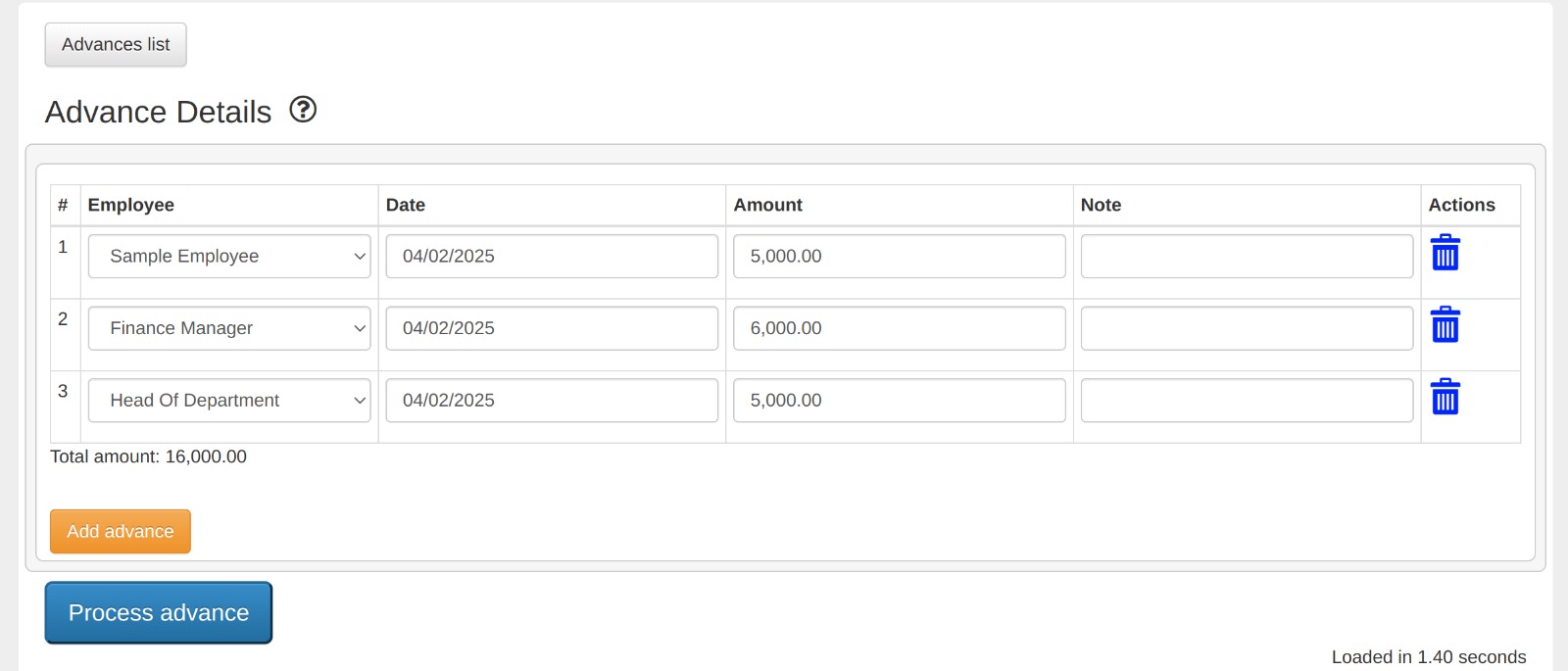

Manage advances. Go to "Payroll" > "Benefits" > "Add advance" button

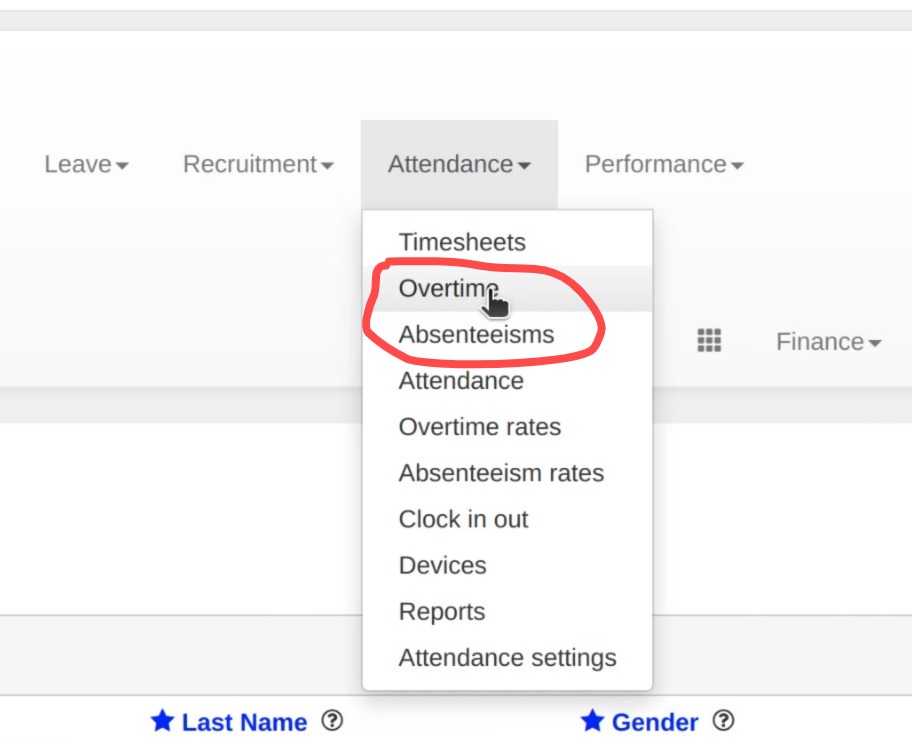

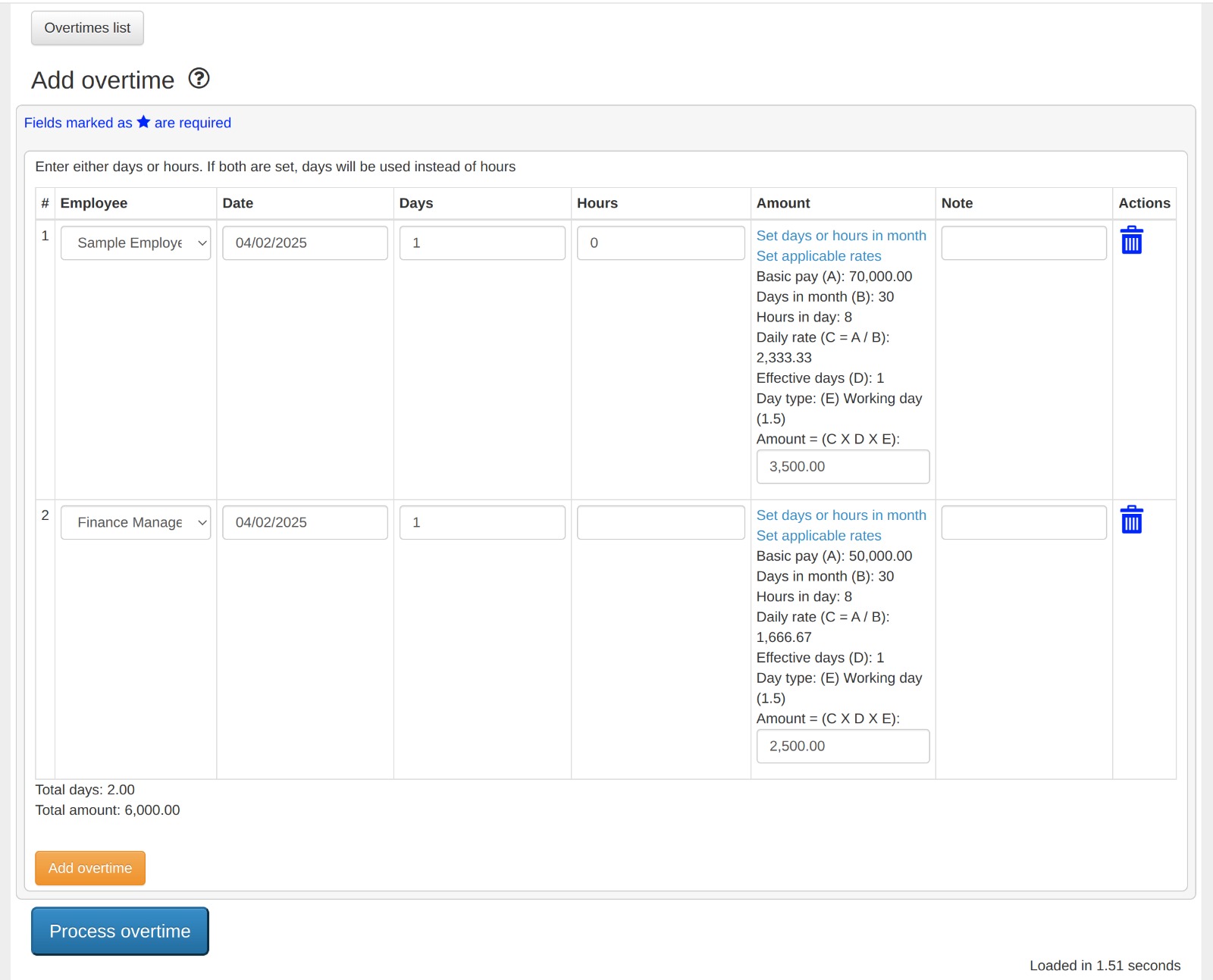

Manage overtimes. Go to "Attendance" > "Overtime" > "Add overtime" button

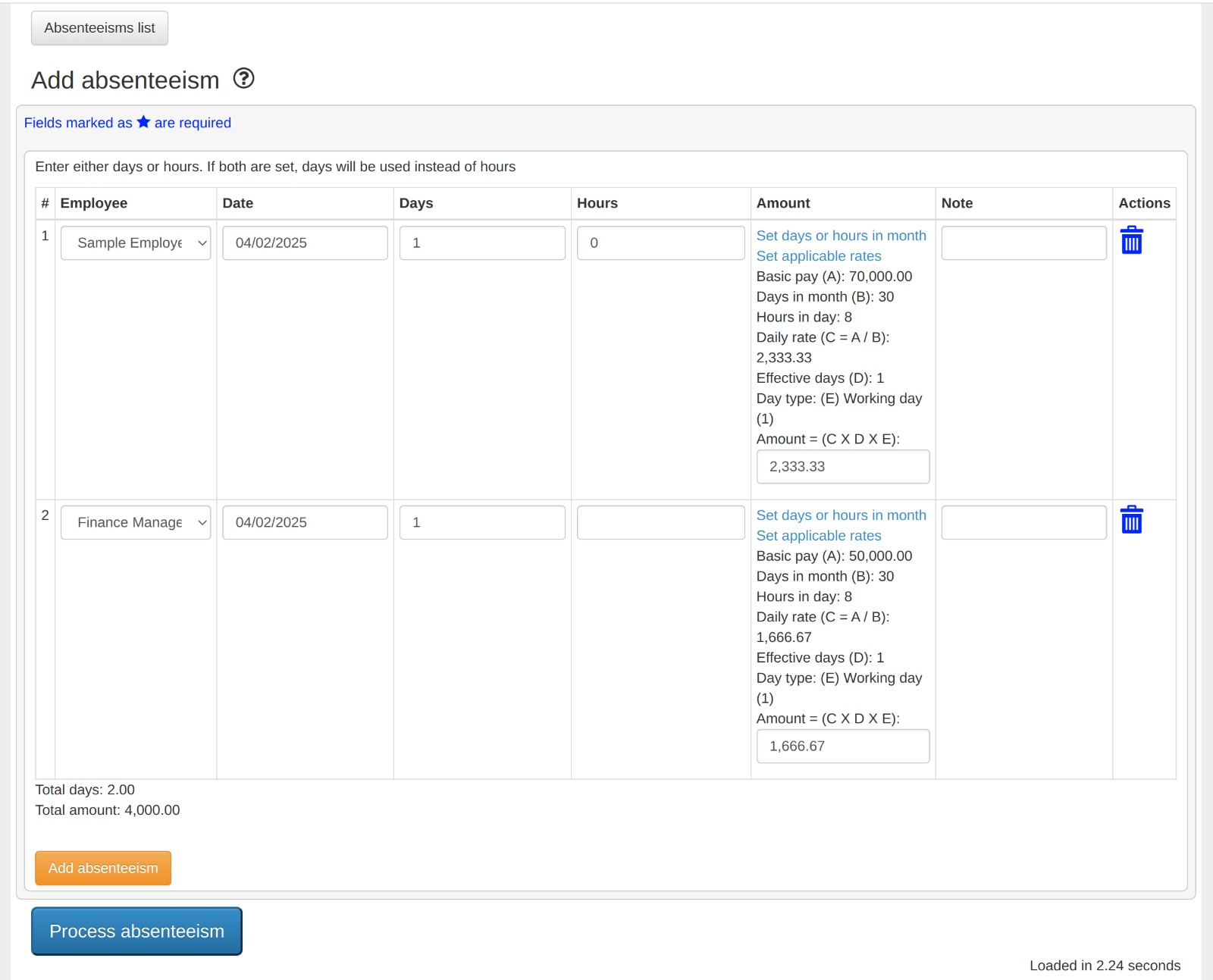

Manage absenteeism. Go to "Attendance" > "Absenteeism" > "Add absenteeism" button

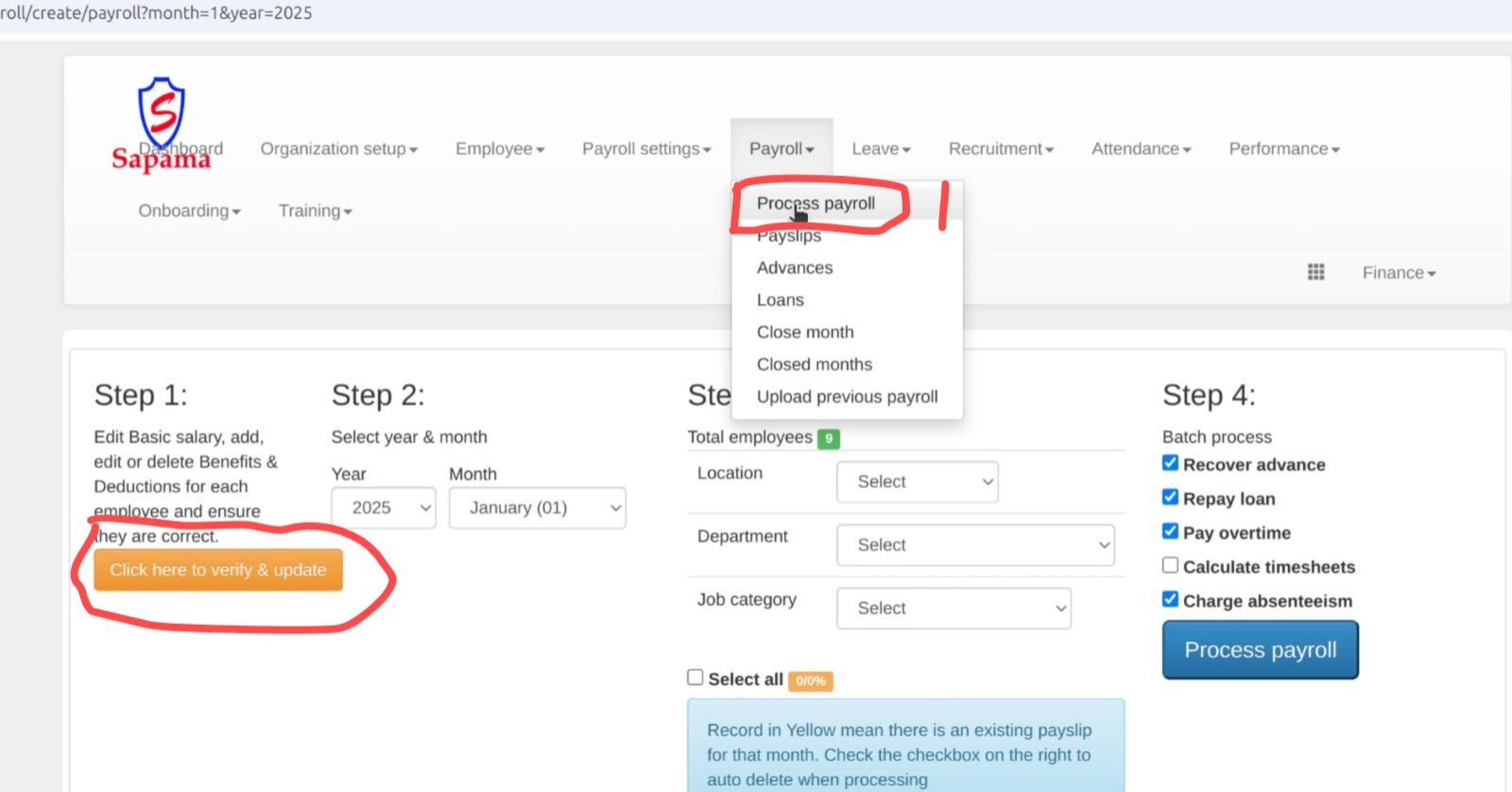

Verify and update individual staff benefits and deductions

Go to "Payroll" menu > "Process Payroll" link > "Step 1 - Click here to verify & update" button

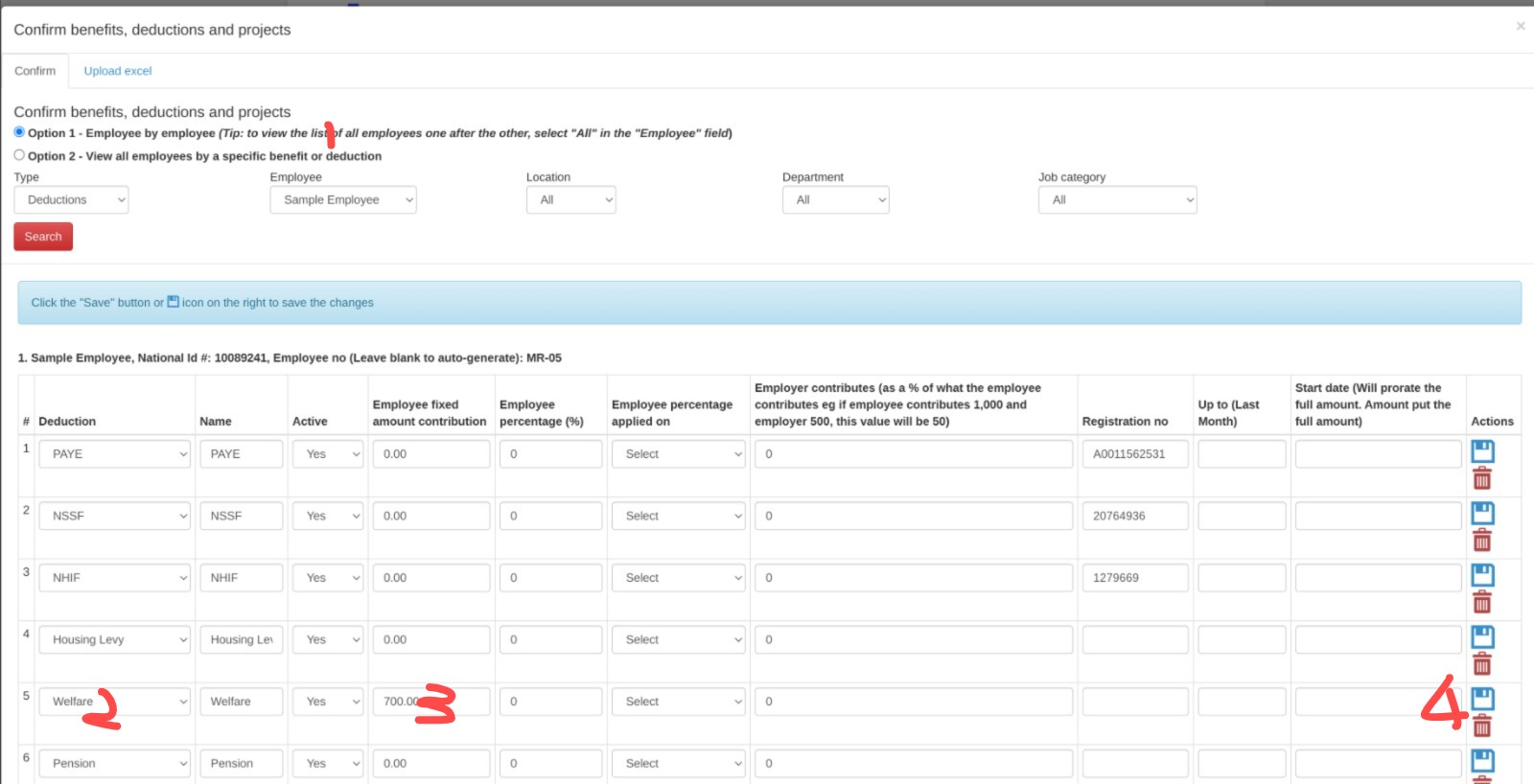

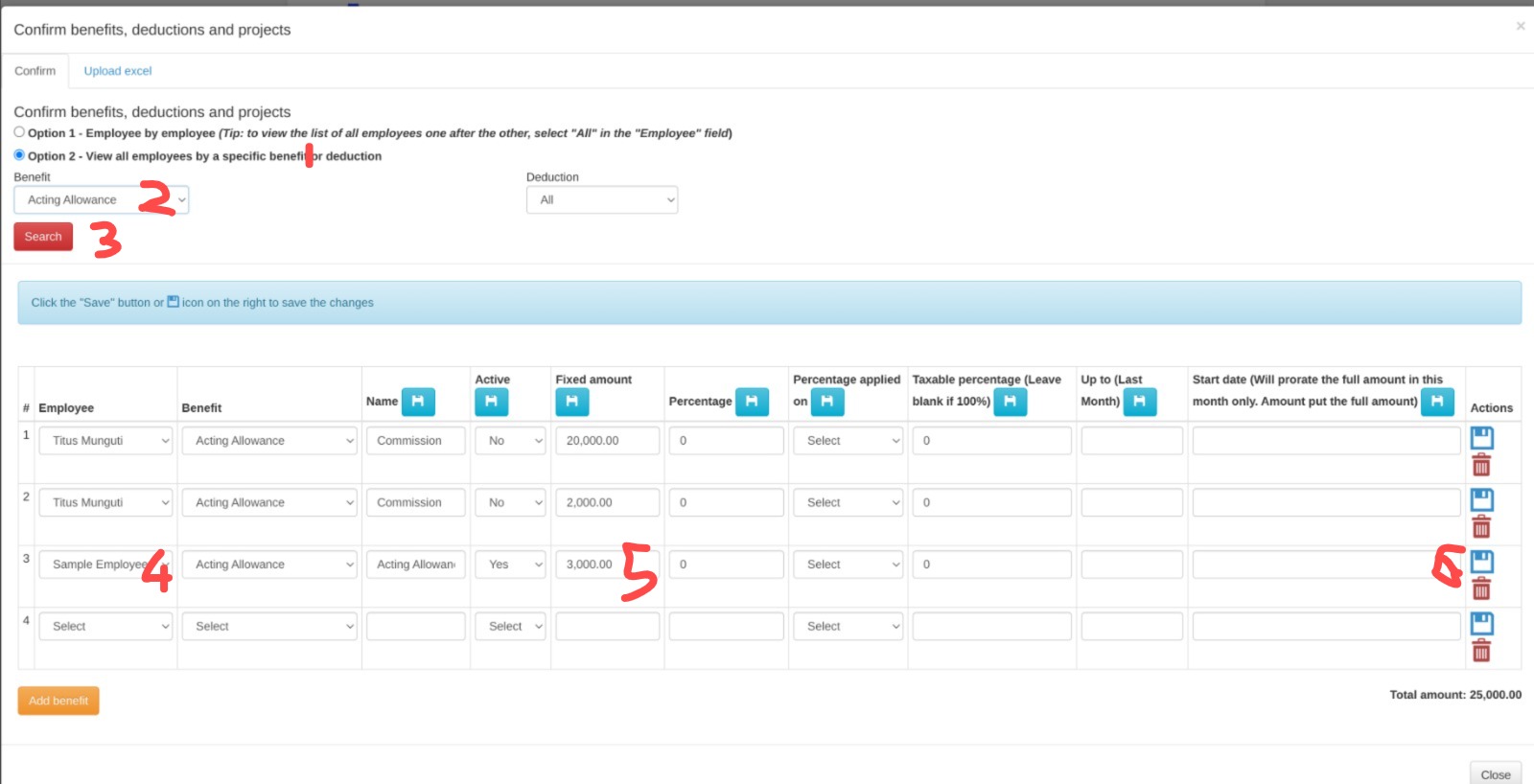

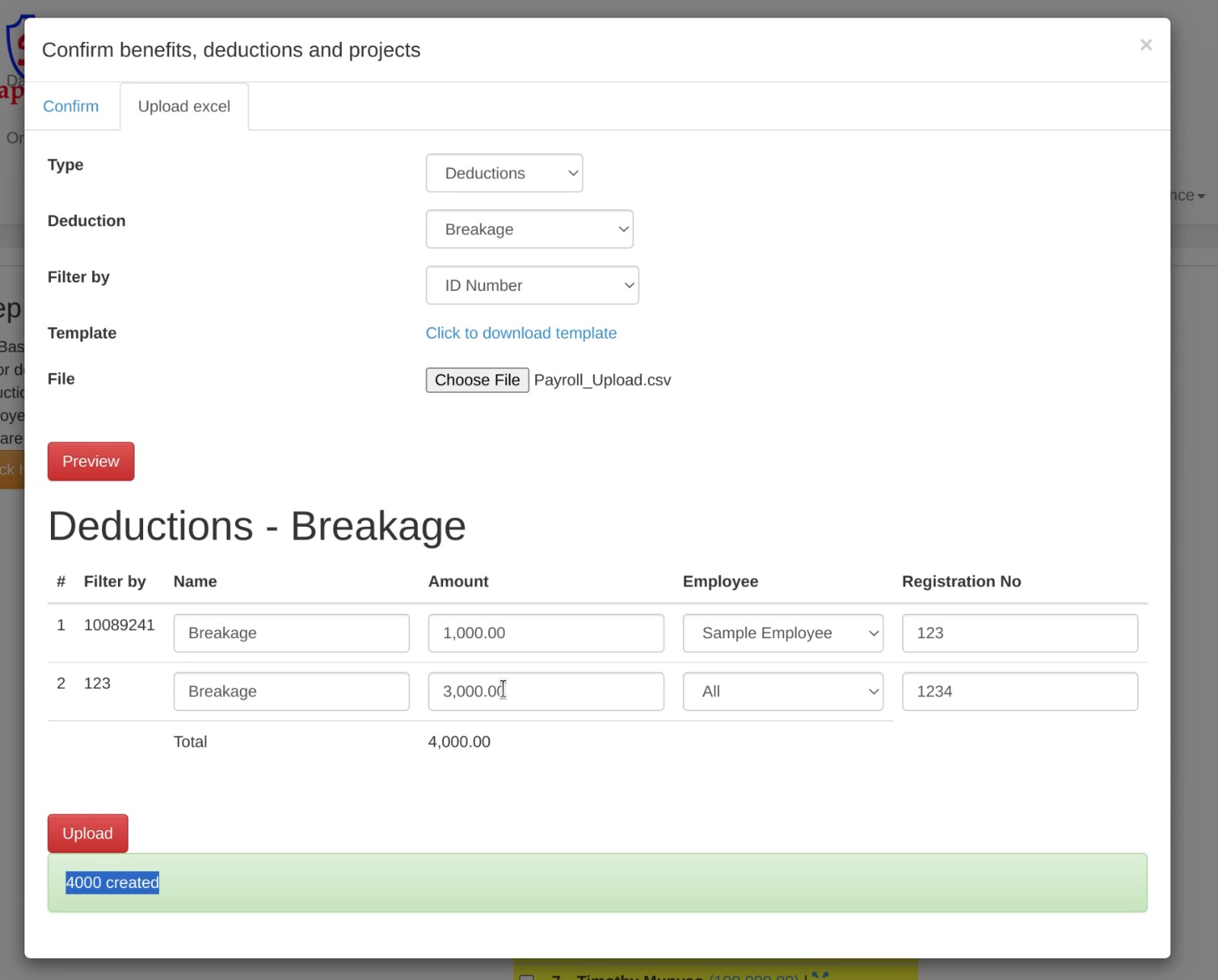

There are three ways that you can update staff benefits and deduction

1. Option 1 - Employee by employee (Tip: to view the list of all employees one after the other, select "All" in the "Employee" field)

2. Option 2 - View all employees by a specific benefit or deduction

3. Import in batch from excel

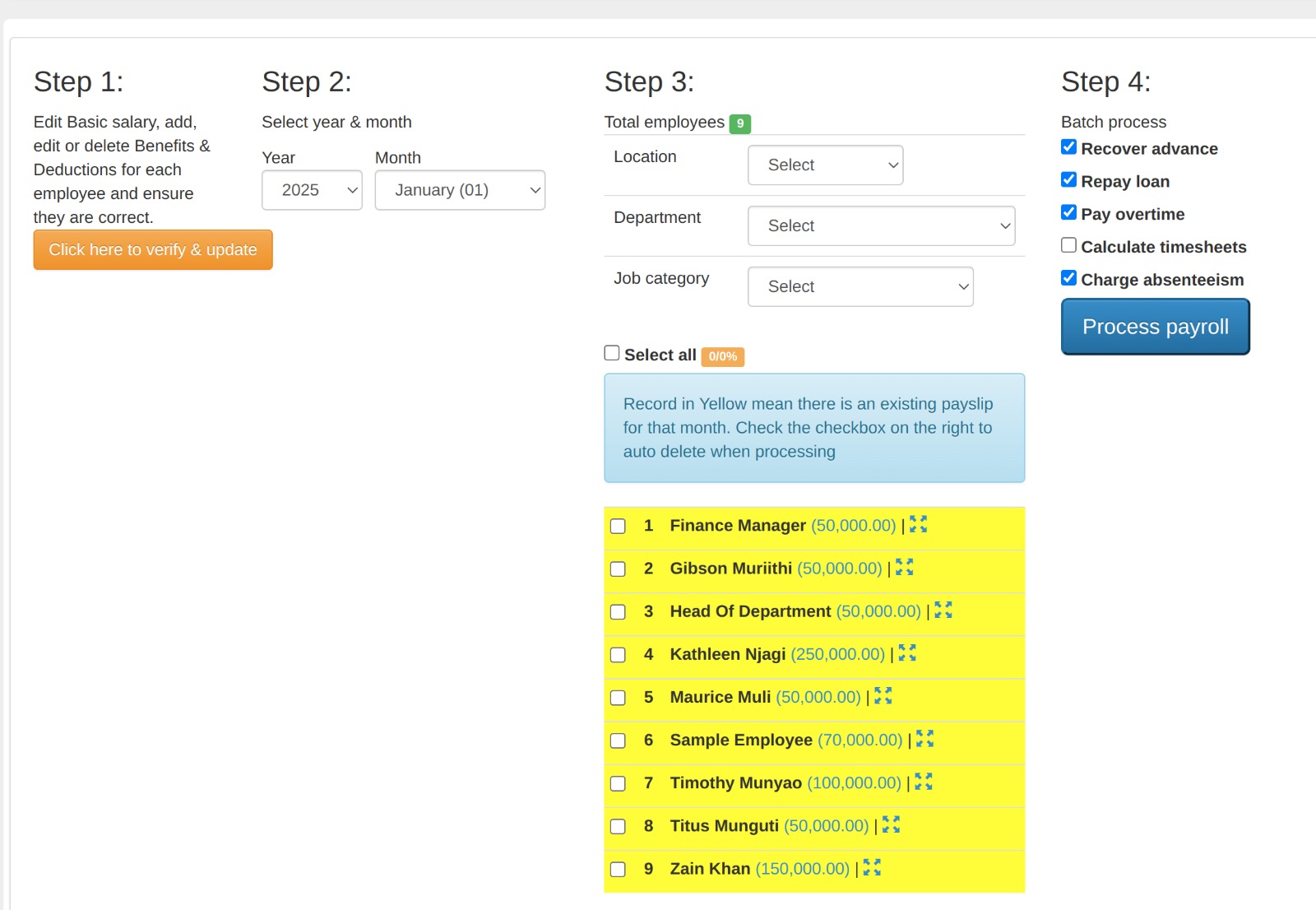

Step 2 - Batch process payroll for all employees in 1-button click

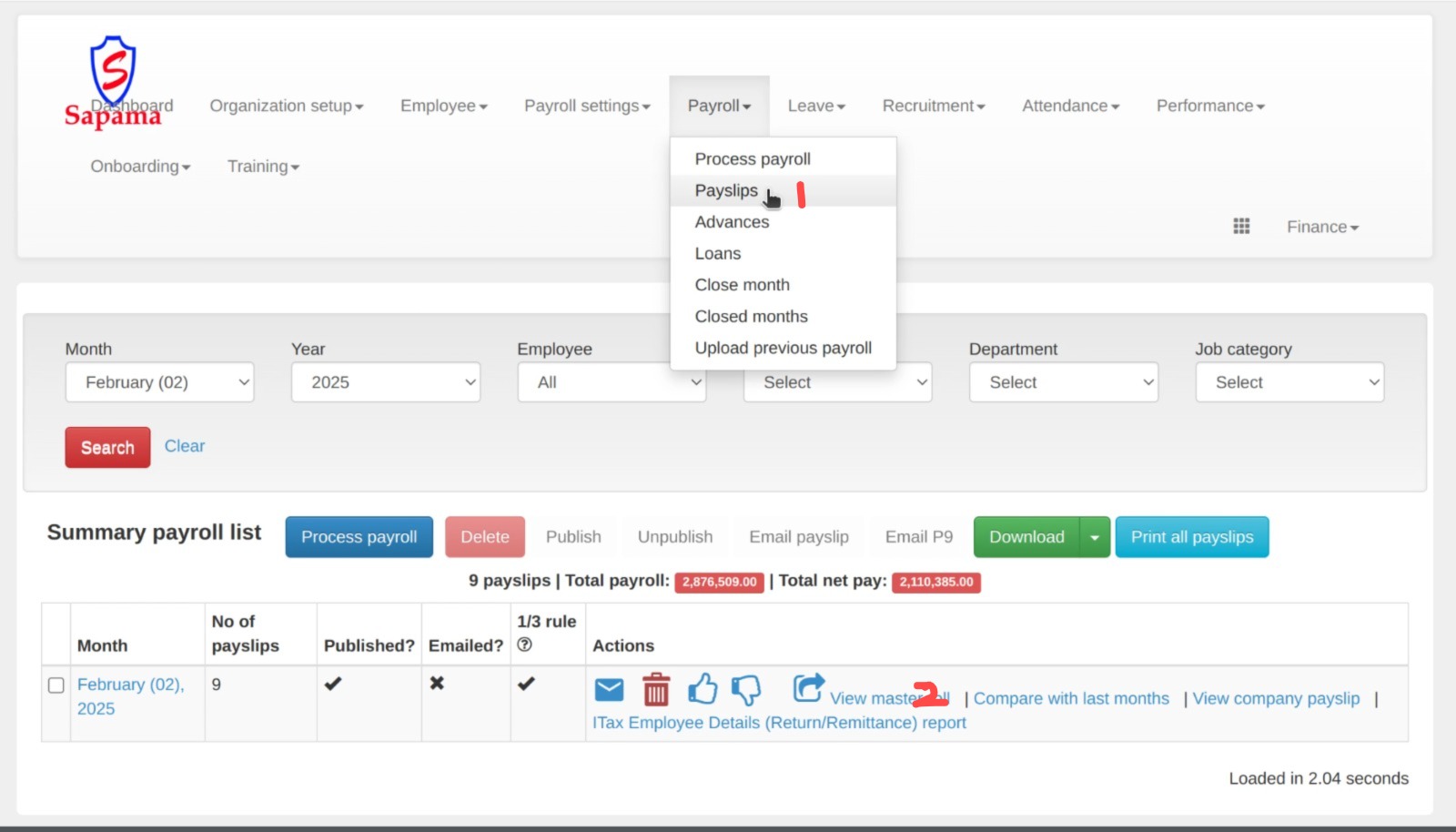

Go to "Payroll" menu > "Process Payroll" link > "Step 1" > Step 2 > Step 3 > Process Payroll

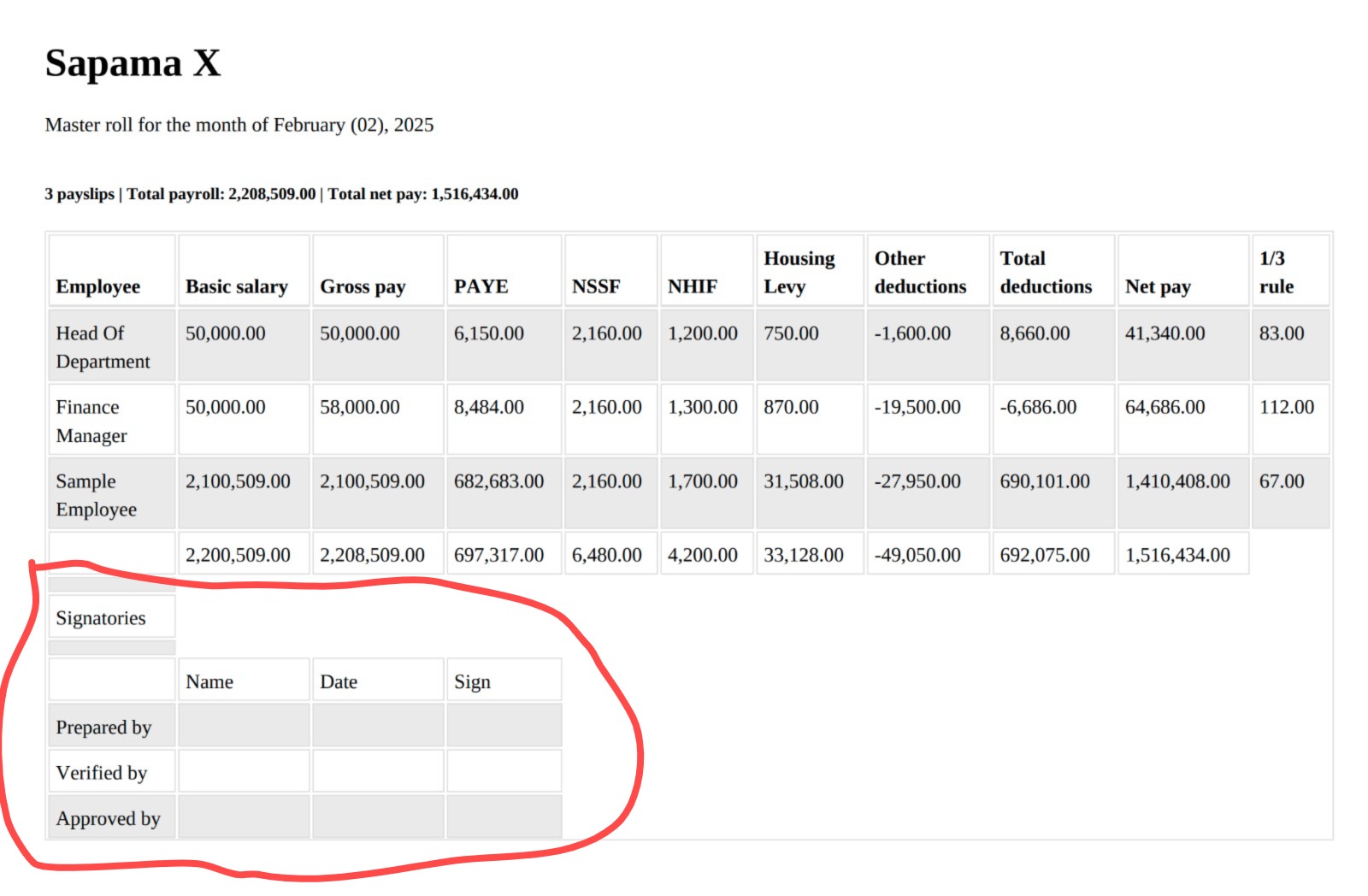

Step 3. Generate master roll and seek management’s approval

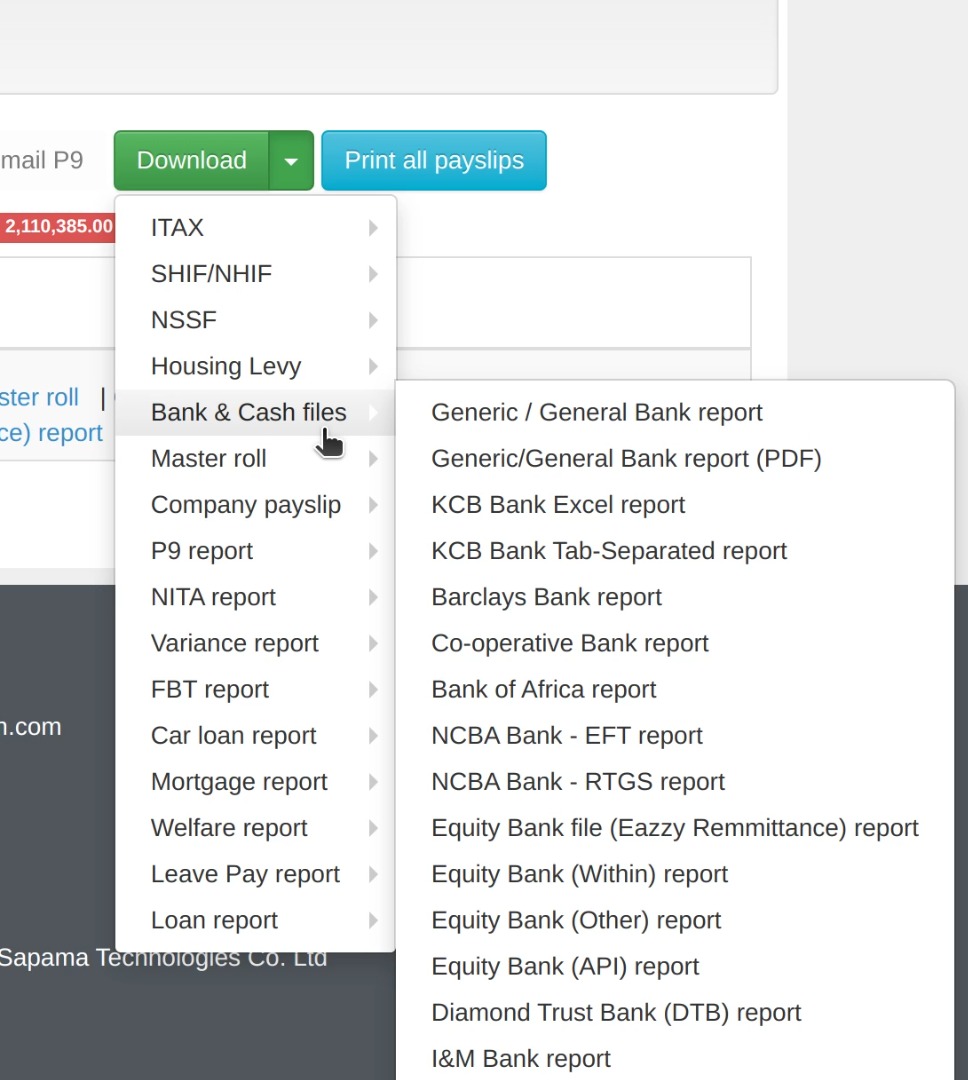

Step 4. Generate any bank file/excel in the correct format

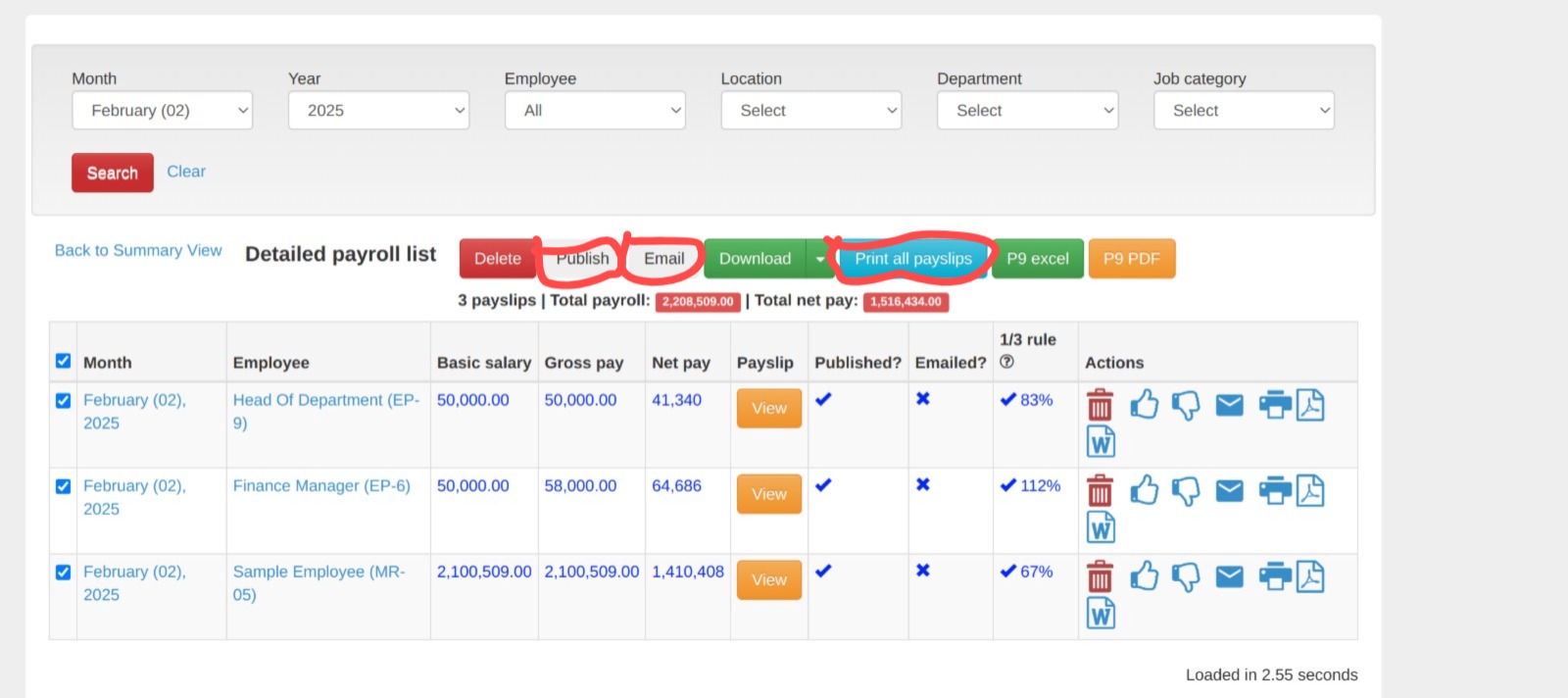

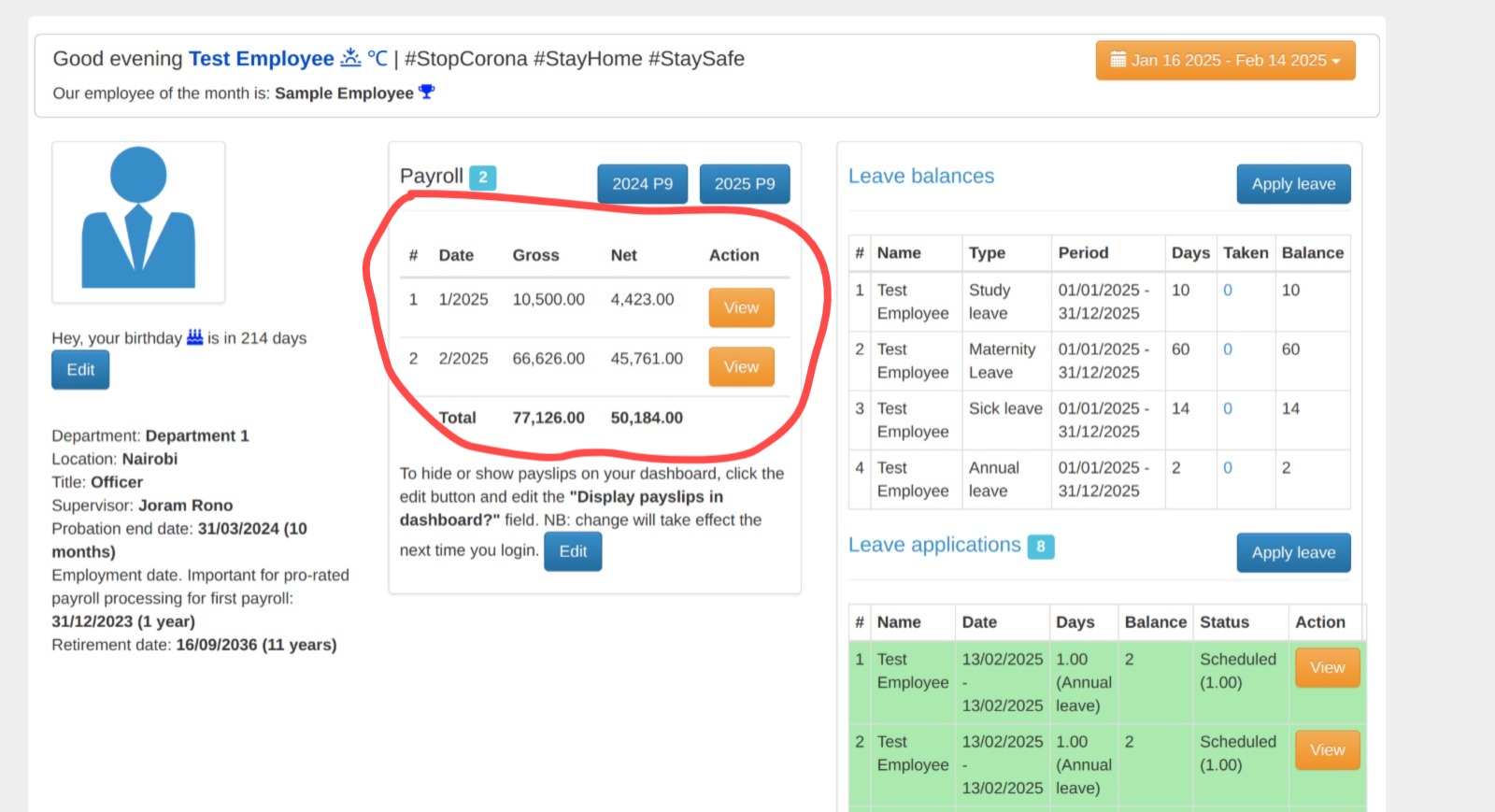

Step 5. View, print, download and email payslip privately

Step 6. Publish payslip to Individual Employee’s Self-Service Portal

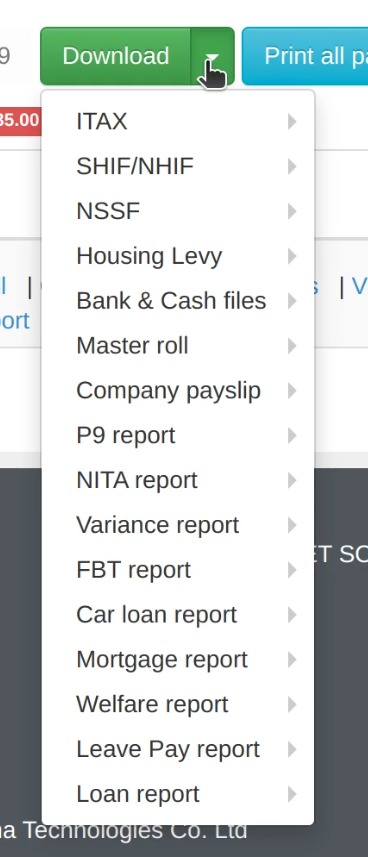

Step 7. File returns in time (ITAX, NSSF, SHIF, NITA, P9, Housing Levy)

Download all statutory reports or by-products in the exact format needed for submission

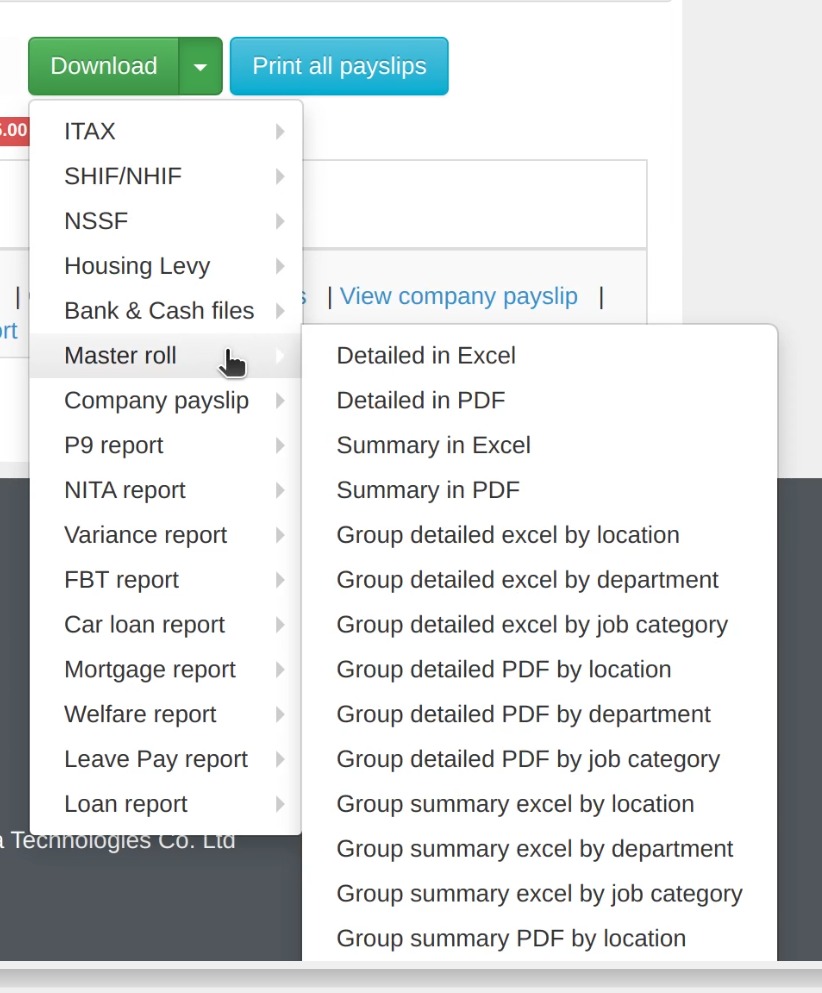

Step 8. File, print or download accurate master roll for record-keeping

Please feel free to contact us for a free demo or trial of our payroll system